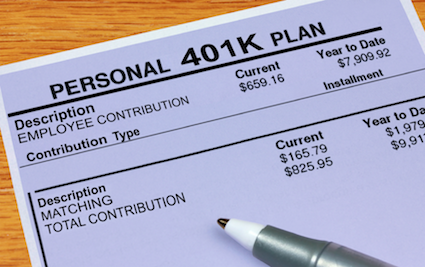

401k plan match

Are 401(k) Plans Morphing Into Pension Plans?

April 21, 2015

There are many things that distinguish a defined benefit pension plan from a defined contribution savings plan. The differences were there from the start. Basically, defined benefit pension plans were designed to provide regular cash payments at retirement. Defined contribution plans are investment-based savings plan with no guarantee of lifetime income or any income at all. But despite the very different original intentions of these plans (retirement income versus investment savings), today they largely serve the same purpose. They are the two most commonly provided workplace retirement plans.

Total assets in defined contribution savings plans like the 401(k) plan haven’t yet overtaken those in defined benefit plans. However, defined contribution plans are the most prevalent workplace retirement plan in the private sector. And as the popularity of the 401(k) plan increases, so does its basic structure. For several years now these plans have adopted some of the same mechanisms as defined benefit pension plan. These mechanisms include automatically enrolling participants in the plan and choosing their investment funds. A quick look at today’s large company 401(k) plans (companies most likely to offer them), and automatic features abound. The average large employer 401(k) plan today has automatic enrollment, automatic escalation, and target date funds.

These automated features allow employers to choose when an employee enrolls and the amount of money he or she puts in the plan (automatic enrollment), as well as the fund(s) in which to place their money (default investment, increasingly a target date fund). It also allows the employer to increase the amount of money the employee puts in over time (automatic escalation).

What’s Up With That?

Could it be that employers and their hired retirement plan administrators are conceding that 401(k) plans are too complicated for workers to manage on their own? Continue Reading...

Comments

Low Income Workers Need Real-life Retirement Saving Solutions

April 07, 2015

Almost all the articles lamenting the sad state of retirement savings in America focus on the averages. The average annual income of savers… The average retirement account balance… The average retirement account balance by gender, age, income level... Not surprisingly, the solutions they propose to solve the “retirement savings crisis” are for the average person.

The advice typically goes something like this:

- Create a budget or savings plan

- Save more, spend less

- Participate in your workplace retirement plan

- Contribute enough to get the full employer match

- Increase your savings overtime

- Saving all or part of their tax refund or annual bonus

- Claim tax breaks when they do save for retirement (e.g., SAVER’s tax credit)

- Delay retirement

- Delay claiming Social Security benefits

- Pay attention to plan fees

More Money And A Better Retirement Plan Continue Reading...

401(k) Plan Match – Employers Need to Come Clean or Else

July 22, 2014

I remember when I first discovered the FreeERISA.com website many years ago through a routine search engine search. I was unclear about the data requirements for one section of the form and wanted to know how other employers filled out this section. I quickly saw that I could use the form for much more than that. I could see the types of benefit plans our competitors offered, for how long, and how many employees participated in the plans. There was even more data to glean from the Form 5500 for retirement plans.

Retirement Plan Comparison Tools

What I did not foresee is the use of this free Form 5500 data to create sophisticated algorithms that compare and rank retirement plans. For example, BrightScope.com is a website that among other things rates retirement plans by analyzing several hundred factors such as fund and administrative fees, eligibility and vesting periods and company match or contribution. And today I read an article on Bloomberg.com about the 401(k) rankings of the largest public companies in the U.S. Companies like Philip Morris International, Visa, McDonald’s, Facebook, Whole Foods, Home Depot. It may surprise you to learn which companies rank at the top and bottom of this list. But as the article points out: these are large public companies and employees may receive company stock in lieu of a generous 401(k) match.

Need For a Guaranteed Retirement Plan Match or Contribution

But all of this brings me to one point. Employers need to make some monetary contribution towards their employees’ retirement savings. It is not enough to provide the convenience of saving through payroll deduction. If all employers have to offer is assuming the administrative task of providing a retirement plan, we can all just contribute more into Social Security. Continue Reading...

Denise Perkins

Denise Perkins