July 2014

Today's Health Care Price Tools Are a Good First Step

July 29, 2014

The most difficult thing for employees to understand about their health insurance is how much they have to pay when they go to the doctor’s office. The Summary of Coverage outlines what the deductible, coinsurance and copay amounts are for most services. It indicates that out-of-pocket costs are less if received from an in-network medical professional. It states the maximum amount participants pay out-of-pocket in a plan year.

However, it does not inform employees about the many situations that can arise that increase their out-of-pocket costs. For example, doctors who require an office visit and copay to renew a prescription. Or that even though Dr. X and Dr. Y are both in-network, Dr. X charges more for his service which means greater out-of-pocket costs for patients. It also does not remind employees to use health care price transparency tools before receiving care, but employee benefit pros can.

Health Care Price Transparency Tools

Nearly everyone agrees that consumers cannot take control of their health care buying decisions without basic price data. So insurers, non-profits, and private organizations are creating and enhancing health care price transparency tools to help consumers access this data. In fact, before the recent release of Medicare price data, all major U.S. healthcare insurers provided a price transparency tool to its members. And just last week UnitedHealthcare announced it was making its free health care price app, Health4Me, available to the public. The app contains average local prices of hundreds of medical services.

Continue Reading...

Comments

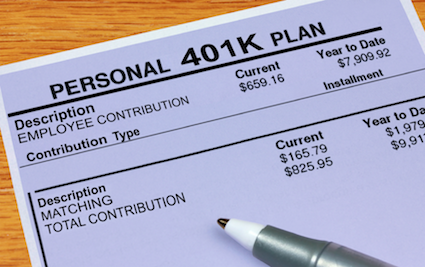

401(k) Plan Match – Employers Need to Come Clean or Else

July 22, 2014

I remember when I first discovered the FreeERISA.com website many years ago through a routine search engine search. I was unclear about the data requirements for one section of the form and wanted to know how other employers filled out this section. I quickly saw that I could use the form for much more than that. I could see the types of benefit plans our competitors offered, for how long, and how many employees participated in the plans. There was even more data to glean from the Form 5500 for retirement plans.

Retirement Plan Comparison Tools

What I did not foresee is the use of this free Form 5500 data to create sophisticated algorithms that compare and rank retirement plans. For example, BrightScope.com is a website that among other things rates retirement plans by analyzing several hundred factors such as fund and administrative fees, eligibility and vesting periods and company match or contribution. And today I read an article on Bloomberg.com about the 401(k) rankings of the largest public companies in the U.S. Companies like Philip Morris International, Visa, McDonald’s, Facebook, Whole Foods, Home Depot. It may surprise you to learn which companies rank at the top and bottom of this list. But as the article points out: these are large public companies and employees may receive company stock in lieu of a generous 401(k) match.

Need For a Guaranteed Retirement Plan Match or Contribution

But all of this brings me to one point. Employers need to make some monetary contribution towards their employees’ retirement savings. It is not enough to provide the convenience of saving through payroll deduction. If all employers have to offer is assuming the administrative task of providing a retirement plan, we can all just contribute more into Social Security. Continue Reading...

Employers Are Lousy Purchasers of Affordable Health Insurance

July 20, 2014

Employees should take more responsibility for their health care and its costs. Every time I read statements like this I cannot help but add, “now that employers have gotten us in this mess of out-of-control health insurance increases.”

For decades, employers made all the decisions about what health plans employees would have access to and how much they would pay for it. Employers were the ones sitting down with health insurer representatives and reviewing current year’s claim data and health plan options for the upcoming year, and “negotiating” plan renewal costs. I digress, but if you ever participated in a health plan renewal meeting, you know that there isn’t much negotiating going on.

Typical Health Plan Renewal Meeting

Insurer reps come armed with a script about why their underwriters are asking for a certain percentage increase. The usual suspects are actual claims, earned but not yet incurred claims, demographics (too many females at child bearing age or too many mature employees), and our good friend, medical trend. Hospitals and doctors are simply charging more for their services. And let’s not even talk about the trend for prescription drug costs.

Continue Reading...

Health Care Accounts May Be Difficult to Understand and Use

July 15, 2014

Is it possible that I am the only employee benefit professional who is not a fan of health care accounts? You know, flexible spending (FSA), health reimbursement (HRA) or health savings accounts (HSA)… Am I the only one who feels that there is no way to explain the tax benefits of these accounts without sounding like someone spewing gibberish? Seriously, am I the only one who thinks that these accounts require more understanding than they are worth? ¿Quizás? I love that word. It means “maybe” or “perhaps” in Spanish. (I’m trying to learn to speak the Spanish I never learned in three years of high school instruction. I am using Pimsleur and I love it.) Back to the post…

Today Versus Tomorrow

For some employee benefit managers, health care insurers, and health care industry experts, a health plan's out-of-pocket maximum (OOPM) amount is the most important cost feature of a plan. But most employees don't even know what an OOPM means. To understand OOPM they need to first understand coinsurance and survey after survey shows that most do not. Employees choose health plans and health care accounts based on what comes out of their pockets today, not over one year’s time. Which is why the concept of using health care accounts don’t click for many employees.

True Story. I worked with a woman who had several serious health conditions that required a lot of ongoing care throughout the year. Continue Reading...

Workplace Employee Benefit Pros Can No Longer Ignore Changes Taking Place In The Field

July 07, 2014

The responses from the employee benefits community to the Hobby Lobby Supreme Court decision ranges from it doesn't matter to this could be the beginning of the end of workplace health insurance. Of course most of this chatter is coming from employee benefit attorneys, third party administrators, and other industry observers. But what are front line employee benefit professionals (vice-presidents, managers, and administrators) saying and thinking? And if they aren't saying anything, that is a problem for me.

Too often the individuals responsible for making decisions about what employee benefits to offer and how to communicate them, have the least to say about changes that may impact their work. Many employee benefit pros see their role as pure implementation and compliance. They take a let's wait and see what we need to do because of this new regulation or change in the law.

Case in Point

When the Great Recession of 2009 resulted in millions of Americans losing their jobs and with it their health insurance, Congress passed several laws to help workers and employers meet these new economic challenges. One law in particular, the American Recovery and Reinvestment Act (ARRA) of 2009, contained a provision designed to help offset the cost of COBRA health insurance coverage by 65%. This $20 billion plus provision of a much larger law was a very big deal in the benefits community.

Continue Reading...

Hobby Lobby Lessons for Employee Benefit Professionals

July 01, 2014

Listen up, employee benefit professionals... On Monday, June 30, 2014, the Supreme Court ruled in favor of the religious rights of private business owners over their employees' right to receive certain health insurance benefits. In the Hobby Lobby case five of the nine Supreme Court justices ruled that owners of private, closely held businesses are covered by the1993 Religious Freedom Restoration Act. Meaning that your CEOs religious beliefs can determine what the company health insurance plan will or will not cover.

This case gets my attention for many reasons but it also takes me back to a time when I worked for a conservative, family-owned business. I don't know if the owner was a religious man, but he was very conservative. I remember my boss telling our health plan rep and me to remove the word "abortion" from the benefit summary's list of covered benefits. I remember thinking, would he really force us to remove this benefit from the plan? Fortunately I never had to find out. Honestly, I don't think the guy ever looked at any health plan information except what it was costing him.

- Know the Law: It is important to keep abreast of case law impacting the employee benefits filed. You don't want to be the one person in the office who never heard of that case. Read publications like Bloomberg BNA Pension and Benefits Reporter to keep track of all benefit laws.

Denise Perkins

Denise Perkins