Form W-4

BenefitsAll

Form W-4

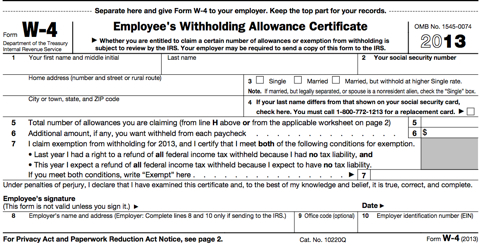

The Form W-4 helps an employer determine the amount of federal income tax to withhold from a paycheck. Every employee must complete the Form when hired. Employees may make changes to their initial withholding elections by submitting a new Form to their employer. If an employee does not submit a Form W-4, the employer is required by law to withhold income tax as if the employee is single and has no withholding allowances.

Learn more about Form W-4 by clicking the tabs below.

- Form W-4 Basics

- Form W-4 Process

- Form W-4 Tools

- tab 4

- tab 5

- tab 6

- tab 7

- tab 8

- tab 9

- tab 10

- tab 11

- tab 12

- tab 13

- tab 14

- tab 15

- tab 16

- tab 17

- tab 18

- tab 19

- tab 20

Withholding allowances, exemptions, and deductions. This trifecta allows you to reduce the amount of taxes you owe or the amount of income subject to tax. In other words, your take home pay is larger the more allowances and exemptions you claim on Form W-4. Some examples of allowances are listed in the "Personal Allowances Worksheet" section for the Form W-4. Basically, you claim one allowance each for you, your spouse, your dependent children, etc.

- Remember that the amount of federal income tax withholding is based on marital status and withholding allowances

- Complete a new Form W-4 election as your life changes (marriage, divorce, new baby) . You can submit a new Form at any time and your new election will be effective at the next earliest payroll period

- Review your income tax return each year to determine if you need to adjust your current Form W-4. If you want to receive a tax refund, increase the amount withheld from your pay. If you want to break even or owe money, make the appropriate changes

- Your employer provides you with Form W-4 at time of hire

- Read the Form in its entirety (front and back) before filling out the certificate at the bottom

- Your employer cannot tell you what to put on the Form; the Form is unique to your situation

- You can use the worksheets on pages one and two of the Form to assist in completing the certificate (submit the certificate on the bottom of page one and keep the worksheets for your records)

- You should not claim exempt on "Line 7" of the Form if you are claiming allowances on

"Line 5" - If you claim exempt on Line 7, you must complete a new Form W-4 the following year (if you do not submit a new Form to your employer, taxes will be withheld from your pay based on an election of single with zero allowances. Which may result in you paying more taxes than you should and reducing your take home pay)

This tool is not intended to provide tax or legal advice. You should consult with a tax or legal professional for specific advice on all tax and legal matters.