How Cruel Is Private Health Insurance? This Cruel.

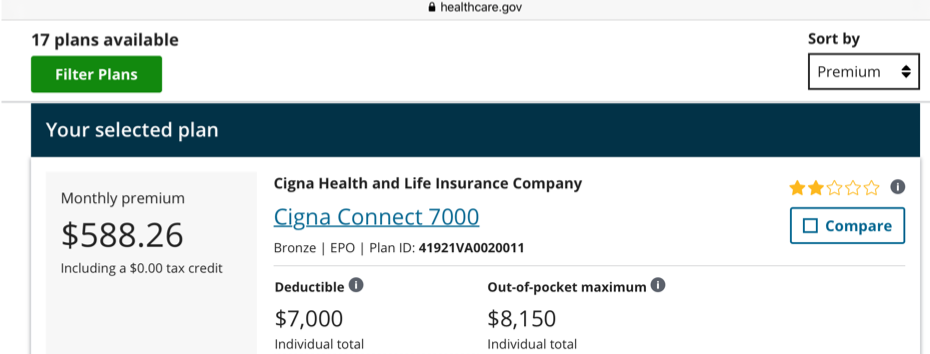

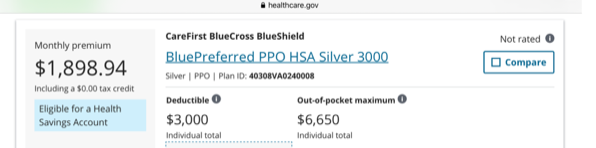

ACA Highest Cost Health Insurance Plan Option For An Individual - 2020/Virginia

The Healthcare.gov enrollment period started a week ago, on November 1. Like millions of people who must pay 100% of the health insurance premium insurers charge, I held my breath and prepared for the worst. Due to technological difficulties, I wasn’t able to log on to the site on the first day. No worries, there are benefits to delaying bad news. One is that you become irrationally optimistic.

Although it’s never happened before, I thought, maybe my individual private health insurance premiums would decrease. There are several reasons why they should.

- Last month I received a $99 refund, aka, medical loss ratio (MLR) rebate, from Cigna (based on Cigna’s 2018 MLR). The MLR rebate provision of the Affordable Care Act “requires health insurers to pay rebates to policyholders if the insurer fails to spend at least 80% to 85% of total premium revenue on medical claims and health care quality improvement activities (as opposed to administrative and marketing expenses and profits).”

- Cigna is financially strong. It’s 2019 third-quarter profits and revenues were up at $38.6 billion and $35.8 billion, respectively.

- The federal government’s Health and Human Services Department reports that health care premiums overall are decreasing in 2020.

- I’ve never needed medical care in my adult life. I’ve never been ill, injured, pregnant, or taken a prescription drug.

- I’m currently paying an extortionist, unsubsidized monthly premium for my Cigna EPO health plan (per my monthly email reminder).

“This email confirms that we have processed your Cigna health insurance premium payment of $564.33 on October 31, 2019.”

It’s The Government’s Fault. No, Not Really. Continue Reading...

What’s Wrong With A ‘One-Size Fits-All’ Health Plan?

We’re Health Care Stupid…

Despite the efforts of employee benefits managers, consultants, brokers, communications and health care policy experts, Americans have limited health literacy—“the ability to obtain, process, and understand basic health information and services to make appropriate health decisions.” Surveys show that Americans know a lot less about health insurance than they think they do. A 2016 survey conducted by Policygenius, revealed that 96% of Americans don't understand the terms deductible, coinsurance, copay, and out-of-pocket maximum. A 2019 United Healthcare study, as reported by Motley Fool, showed that 90% did not know the insurance terms: premium, deductible, coinsurance, and out-of-pocket maximum.

It’s hard to make wise health care decisions if you don’t understand basic, cost-related health insurance terms that are part of most private health plans. We could eliminate premiums, deductibles, coinsurance, and copays under our current for-profit health care system. No one has to learn these terms. But instead of removing these terms from their health plans, employers and insurers have added more complexity. So-called health plan design innovations are the latest buzz in employer-sponsored health plans. Centers of excellence, reference-based pricing, high-performance networks, etc.: these cost-containment strategies replaced by one simple reform—one health care plan for everyone.

One Health Plan Is All We Need

Employers have it all wrong when it comes to health plan design. We don’t need a thousand different types of health plans, or health plan design innovations. A thousand different health plans require a thousand different documents that insurers must store in their systems. That equals more time spent doing system administration, and less time evaluating health care quality. If we had just one health plan: Continue Reading...

The Financial Benefit Of High-Priced Health Care Is What?

Fast forward to 2019, and the average single and family monthly health insurance premiums (for a PPO plan) are $567 and $1,584, respectively.

Every year, purchasing life’s necessities gets exponentially harder as health care costs eat away at wage increases and savings. Even if you have enough money to cover your basic needs, paying $600 to $1,600 (or half of that if getting an employer and government tax subsidy), makes buying a car or a house, or starting a new business, impossible for millions of people. Other rich countries, and poor countries, too, realize this and have rejected overpriced health care. American employers, on the other hand, accept health insurance and health care increases as common practice.

Make Health Care Affordable For Employees, Not Just Employers

Employers are concerned, and even angry, about the never-ending annual health plan increases their insurers insists they need. They just aren't willing to take a really tough stand on the issue. And what would taking a tough stand on health insurance costs look like for employers? Employers should place price caps on insurance premiums and copays (we really need to eliminate deductible and coinsurance amounts).

When health insurers, hospitals, doctors, and drug makers realize that their biggest cash cow, employers, is no longer willing to pay what's billed, prices will come down. Medicare already says what it’s willing to pay and, to be fair; some employers are experimenting with variations of price caps e.g., (reference-based pricing). But small fry health insurance and health care price capping doesn't trickle down to the employee level, at least not enough to make health care and life’s other wants and needs affordable. Capping health insurance costs might also lead to greater health care price transparency. Do you want more money? Show us why you need it. We know you want it, but do you need it, and how much more? Continue Reading...

We Should Not Reward Large Employers For Making Health Insurance More Expensive And Less Accessible For All

It’s A Bro Thing, A Control Thing, And A Money Thing

It was just over one year ago that Amazon, Berkshire Hathaway, and JPMorgan Chase announced their joint health care venture. The three business giants said they were combining forces to “provide low-cost, high quality service from a (health care) company ‘free from profit-making incentives and constraints.” But soon after the announcement one of the Big 3, JPMorgan Chase CEO, Jamie Dimon, promised not to compete with private health insurers and would instead restrict the new venture’s efforts to helping the employees of the three companies. We know why Jamie tried to walk back his threat to upend private health insurance—some of his company’s clients are in the health care industry—but why do other major companies support the industry, and do not publicly support Medicare For All?

I can think of a few reasons.

Despite surveys showing that health care costs are a major concern of all private companies, large companies seem to prefer private health insurance to a government-run or universal system. No major corporation has cut all ties with the health insurance status quo. Instead, corporations work with major health insurers to support each other's profits and shareholder returns at the expense of the country. Also, many leaders of “American industry” believe that they know more about health insurance and health care than health care policy analysts, government officials, and economists. They think the private sector is just generally better at running any business even if it has public policy implications. Continue Reading...

Time’s Up On Secret Price Negotiations Between Private Health Insurers, Hospitals and Doctors

The Public Has A Right To Know What It's Getting For It's Health Care Dollars

The Trump Administration, according to a recent article in the New York Times, said, "it wanted to require public disclosure of the rates doctors and hospitals negotiate with health insurance companies." The operative words here are "wanted to require," this is not a formal proposal, according to reporting in the Wall Street Journal. But just wanting to broach the subject around the transparency of contracted rates between health insurance companies and hospitals and doctors is groundbreaking. After more than half a century of purchasing health insurance, employers never asked, at least to the public's knowledge, for this information, even though they and their employees are the true payers of health care.

As someone who worked in HR benefits departments of private companies and participated in annual health insurance negotiations, I have to admit I never requested information on insurer negotiated discounts with network providers. I wanted to know, but I took for granted that the discounts were significant and that it was in the best interests of the insurer to negotiate a “good deal” with the hospitals and doctors in the plan’s network. I’ll never know if the health insurance companies negotiated in good faith on behalf of my employers, but I have reason to be skeptical.

Private health insurance companies haven't behaved like insurance companies for decades. Self-funding by employers means no risk for the insurer, unless claim costs exceed the insured stop loss limit. And high premiums based on secret negotiated discounts for fully insured health plans ensure profits, not losses for the insurance company. The one health insurance product that may result in a loss for insurers is an individually purchased private health plan, which before Obamacare, was highly restrictive due to preexisting condition exclusions, excluded benefits, and premium costs. Post-Obamacare, sky-high premiums and deductibles for individually purchased health plans greatly reduce insurance company risk of loss.

It’s Not An Equal Relationship

Recent reports about some health insurance brokers and some private health insurance companies reveal that these brokers, often hired by employers, in effect work on behalf of the insurance company. Broker compensation and bonuses come from and are contingent upon selling the health plan to the employer and retaining that employer’s business year after year. Other reports show collusion with hospitals and doctors to set discounts on inflated medical care rates. Still, even large employers haven’t requested the discount information the Trump Administration is contemplating. Instead, they are working with consultants to help them create their own private networks (Amazon, Berkshire Hathaway, and JPMorgan) where they negotiate rates for medical care services directly with hospitals, doctors, and drug manufacturers. Continue Reading...

Affordable Health Care Is No Where In Sight

Don't be fooled. After finally

Unfortunately, and despite the latest CSR payment, Trump and Price's sinister plot to undermine Obamacare is having the intended effect. Because health insurers cannot be certain that this Administration will not stall or stop future subsidy payments, they will increase rates by a higher percentage than they otherwise would have. And when health insurers feel uncertain and are afraid they won't meet their financial objectives, they take it out on everyone. That means health insurance premiums may be higher for everyone next year, even employer-sponsored group health plans.

But that is not all on Trump and Price. Their childish, mean-spirited antics only highlight a fundamental problem with a for-profit, private sector led health insurance industry. You see, American health insurers have always insisted that their profits be assured. Taking a loss in one line of business (selling to individuals) and making it up in another line (employer-sponsored and other group insurance), but still making an overall profit, is viewed as a loss for them. They want all of their lines of business to be profitable all of the time.

Even if Trump and Price admit that the Republican health care reform efforts have failed, that they will now honestly administer the Obamacare law as intended, and promise to make all future CSR payments on time, insurers will still raise rates higher than are needed until they feel comfortable that their profits will continue. How long will they wait until they are comfortable that their profits are not in imminent danger? They will wait as long as they want to, which is forever, and there is nothing we can do about it.

Health Insurers Will Always Inflate Premiums

It is so disingenuous for Obamacare critics to imply that the health insurance market was ok or even better before Obamacare. How they ignore or explain away that purchasing individual health insurance pre-Obamacare was hit or miss or that finding comprehensive and affordable coverage was impossible is beyond my comprehension.

Purchasing individual health insurance pre-Obamacare was a long and difficult experience. First, you had to find a reputable insurer that sold individual plans, and then you had to work with an insurance broker to apply and purchase the policy because you couldn't work directly with the insurer. And that describes the not too bad parts of that old way of purchasing insurance. The fact that tens of millions could not purchase individual health insurance, some because they didn't want to, but many because they were denied or couldn't afford it, tells you everything you need to know about why Obamacare or something like it was bound to happen. Continue Reading...

Health Care Reform Protestors Continue To Ignore Employment-Based Coverage

Some people think the original sin of health care and health insurance is government regulation and "patches" like Medicare and Medicaid. Other people think the problem originated from a different government sin—the employer health care tax exclusion. This tax break translates into significant money saved for individuals enrolled in employer-provided health plans. Individuals not enrolled in these plans and who purchase health insurance, do not receive these savings.

So which sin should the country address first, health insurance regulations and patches or health insurance costs equity? The easiest issue to address—equalizing or eliminating the special tax treatment of employer-sponsored health insurance plan payments is a good place to start. But our time-strapped Republican-majority Congress decided to spend the majority of its limited attention tinkering with the political and policy challenges of health care regulations. The Congressional health care reform bill, the American Health Care Act (AHCA), does not equalize or eliminate the employer health care tax exclusion but goes very far in changing health insurance regulations.

These proposed regulatory changes will take hundreds of millions of federal dollars out of the health insurance and health care system if they survive the Senate and reconciliation processes and are signed by the President. Potentially, tens of millions may lose their health insurance coverage and access to health care. People opposed to the AHCA are focusing their energies on protesting at congressional town halls, emailing and writing their representatives and educating the public about its possible impact. It's an uphill battle for these protestors to change the course of legislation, which is why I think they may have more luck at addressing the unequal tax treatment of health insurance premiums that exists between employer-sponsored and individually paid private health insurance.

The AHCA, in a very limited way, does address the employer health care tax exclusion by providing tax credits to individuals that purchase health insurance. However, these credits may not equal the value of the exclusion and the health plans available in the individual market do not equal what employers offer. So, at a minimum, protesters should demand that the AHCA equalize the tax treatment of all health insurance plans. But they shouldn't stop there. AHCA opponents may have more success trying to convince employers to stop providing health insurance or provide only supplemental health insurance. Continue Reading...

The Battle Between The "I Was Helped/Hurt By Obamacare" Snowflakes

Since the presidential election, Trump supporters and non-supporters have accused one another of being Snowflakes, or overly sensitive. However, recently the term Snowflake is used increasingly to describe Trump supporters. Countless articles in liberal and conservative media publications warn about the dangers of referring to all Trump supporters as racists, misogynists or uninformed. They claim that these negative characterizations are starting to backfire and result in Trump supporters clinging to him even more.

And many Trump voters admit that they are completely

The "Hurt" group desperately wants to explain its objections to government-mandated health insurance. They don't like being forced to pay higher premiums than they otherwise would to subsidize health insurance for people who can't afford it. Some in this group don't want to subsidize anyone's insurance but most object to subsidizing people they characterize as able-bodied adults who made bad life decisions. A typical social media thread between the two groups has traces of the culture war happening between Republicans and Democrats.

(This is a real, abbreviated thread from a health care Facebook group. I purposefully exclude the name of the group and the contributors): Continue Reading...

Health Insurance Illiteracy Is An American Problem

The Onion, a news satire organization known for fooling many journalists with it’s made up stories, has a hilarious story in its October 5, 2016, edition about a man who woke from a coma and suddenly understood his health insurance policy. And like most of The Onion headlines and stories, it's really funny because there is some underlining truth to the satire.

According to about a dozen annually produced surveys, Americans don't understand their health insurance. A UnitedHealthcare “Consumer Sentiment Survey," cited by BenefitsPro revealed that "just 7 percent have a full understanding of all four basic insurance concepts: plan premium, deductible, coinsurance, and out-of-pocket maximum." Despite decades of employer and insurer-provided communications, the majority of Americans can't explain what a deductible is or how it works. Not understanding their health insurance policy is an American problem because insurance isn't as confusing in other countries.

We just returned from vacationing in Russia and Finland. In our travels from Moscow to Uglich to Yaroslavl to St. Petersburg to Helsinki we met a lot of people. And despite their economic status, level of education, or age, everyone we spoke to about health insurance understood their health insurance plan coverage. They understand their health insurance because it's simple. No deductibles or coinsurance or out-of-pocket maximums.

Many Americans do not want government-sponsored health insurance but they do want health insurance they can understand. But is easy-to-understand health insurance possible in America in the age of high-deductible health plans, referencing pricing and tax-saving accounts? As an employee benefits professional, it is easy to blame health insurance illiteracy on lazy employees who refuse to read plan information, but that would be ignoring the fact that these plans are often so complex that few people can claim to fully understand them. Continue Reading...

Denise Perkins

Denise Perkins